Workers’ Compensation and Your Small Business

A workers’ compensation insurance policy provides benefits to employees for injuries and illnesses arising out of and in the course of employment. The policy may provide payment for medical treatment, temporary and permanent disability and death benefits. Workers’ Compensation Insurance is unlike any other type of small business insurance in that it is regulated by the states.

Workers’ compensation insurance was created to protect employees and help employers cover the cost of workplace injury care, but many small business owners think it’s just an extra—and unnecessary—cost for their company. Whether your business is small or large, handling the expense and effort of meeting those obligations is an ongoing challenge.

There’s a 50% Chance Your Business Will Get an Injury Claim in the Next 10 Years. You may think that because your business is small, it’s very, very unlikely that you’ll ever deal with an employee injury. Not true. Hartford’s claims data analysis determined that there is a 50% chance that a small business will experience a claim in the next 10 years.

Work-related injuries vary based on the industry. What are the most common workplace injuries?

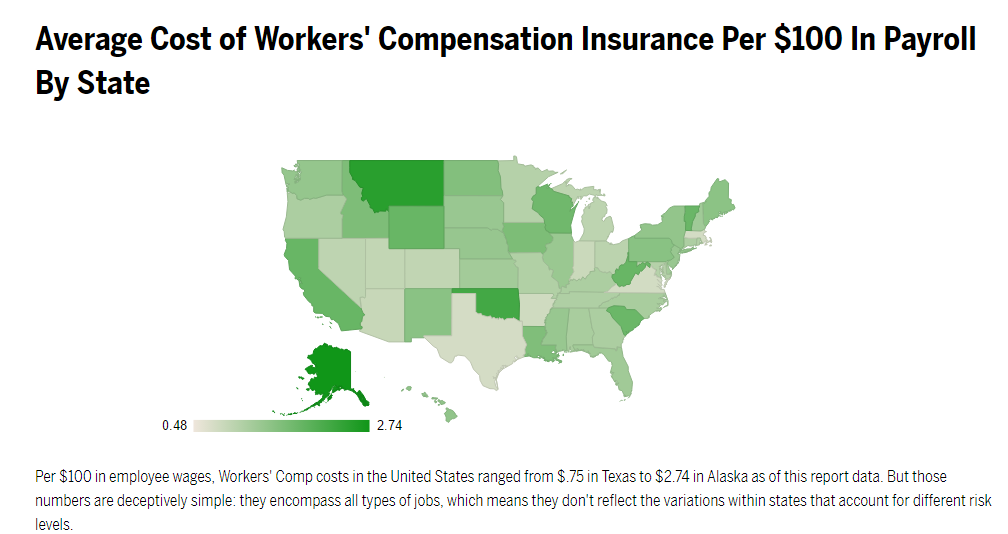

Varying coverage requirements come with varying prices. Below is a map that shows how much Workers’ Compensation Insurance costs around the United States, per $100 in payroll.

What steps can you take to evaluate your State-by-State Workers’ Compensation Exposures?

- Examine your company’s possible exposures to workers’ compensation claims from different states. If you have employees who live and work or who travel to other states, you need to make sure you are properly covered in each state.

- If you have workers in monopoly-fund states, you’ll need to arrange coverage through those state funds. Private insurance cannot satisfy coverage requirements for monopolistic states.

- If you’re based in a monopoly-fund state but have workers based elsewhere, you will need to arrange coverage for those states separate from your state fund.

- If you’re self-insured in your primary state of operations but have employees or uninsured contractors in other states, you’ll need to arrange coverage for those other states.

- If you’re operating in multiple states, check into possible different classification definitions that apply in different jurisdictions for your operation. Make sure you’re properly classified in each state, to avoid either hidden overcharges or an unpleasant audit surprise of an additional premium.

- A few states do not use the interstate experience modification factor system, but instead calculate a modifier only for use within that state, based on prior losses and payrolls within that state. These “stand-alone” states are California, Michigan, Pennsylvania, Delaware and New Jersey.

What can you do to reduce the workplace injury?

- Perform regular safety inspections to identify and remove existing hazards

- Keep the floor clear of any material that could cause a worker to trip

- Provide employees with necessary protective gear

- Schedule thorough safety training for new employees and have refreshers for seasoned employees

- Provide open spaces and clear access for equipment and materials that need lifting or handling

- Display posters, brochures, etc. with safety reminders and tips

If your company needs assistance with Workers Compensation or the overall safety of your workplace contact us today!

Jim DePew

Vice President & Consultant

Mobile: (330) 631-9022

Office: (330) 915-2355 Ext: 103

Email: jdepew@bdewees.com